Papua New Guinea Introduces Exemptions on Consumption Tax for Basic Items

The latest budget announced by the Papua New Guinea government aims to reduce costs for families by introducing exemptions on consumption tax for a range of basic items. In its budget speech, Treasurer Ian Ling-Stuckey outlined a K28 billion budget themed ‘Securing PNG in 2025 and Beyond’, which includes these significant changes.

Exemptions on Consumption Tax

Household goods such as rice, tea, coffee, tinned fish, tinned meat, flour, chicken, and noodles, along with diapers, and sanitary pads, will no longer be subject to goods and services (GST) charges. This move is expected to reduce costs for families and provide them with some relief from the burden of living expenses.

According to Treasurer Ling-Stuckey, this budget marks a turning point in building the security necessary for creating the future our children deserve. He stated that “This Budget provides the framework, for starting to make life better, for our people in the next 50 years.”

Budget Highlights

The K28 billion budget includes several other significant changes, including an increase in income taxes for high-income earners. People earning more than 70,000 kina (around NZ$29,000) will now pay 40 percent tax on earnings above that amount.

In a call for similar measures to be introduced by economist Andrew Anton-Mako in October last year, the government’s decision is seen as a step in the right direction. While there may still be concerns about the impact of these changes on certain groups, the introduction of exemptions on consumption tax for basic items is a welcome move that aims to make life better for families.

Conclusion

The Papua New Guinea government’s latest budget introduces significant changes aimed at reducing costs for families and building security for the future. The exemption on consumption tax for basic items is a notable change, and while there may be concerns about other aspects of the budget, this move is seen as a positive step towards making life better for our people.

Ian Ling-Stuckey announcing the K28 billion budget.

Photo: Facebook / Papua New Guinea Parliament

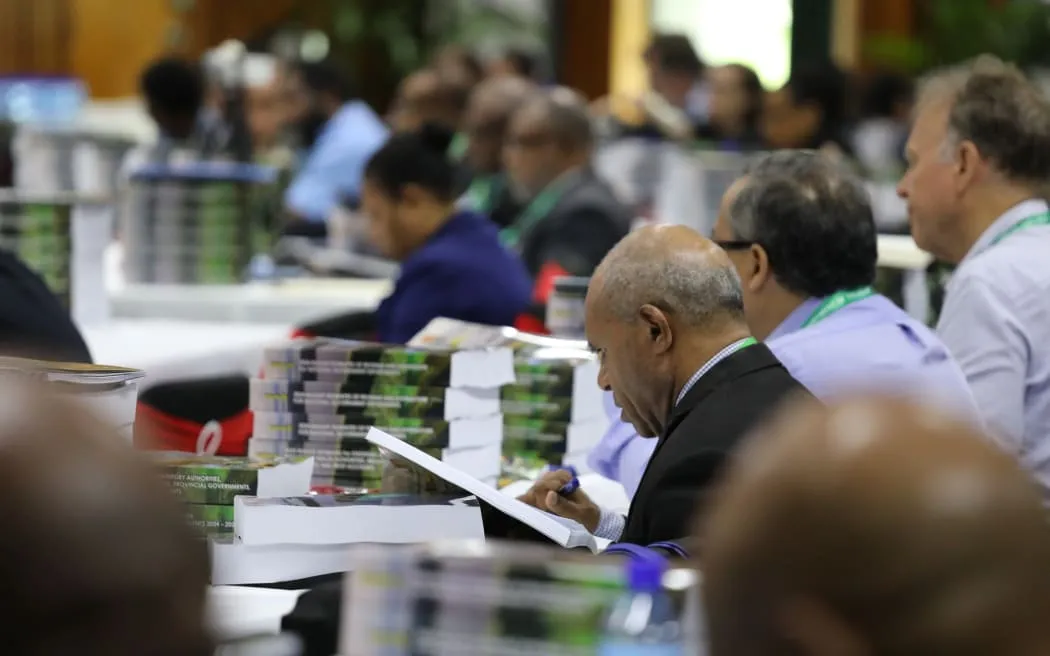

PNG 2025 National Budget press lock-up held in the State Function Room at Parliament House. 30 November 2024

Photo: Facebook / Papua New Guinea Parliament

Ian Ling-Stuckey announcing the K28 billion budget.

Photo: Facebook / Papua New Guinea Parliament

0 Comments